Managing your finances can feel overwhelming, especially when unexpected expenses pop up or your income fluctuates. But with a solid monthly budget plan, you can take control of your money, reduce stress, and start building savings with confidence.

Why Monthly Budget Planning Matters

A monthly budget acts as a roadmap for your finances. It shows you where your money is going, helps you identify areas to cut back, and ensures that you’re saving for future goals. Whether you’re trying to get out of debt, save for a vacation, or just feel more in control, budgeting is the first step.

Key Benefits of Budget Planning:

- Track your income and expenses clearly

- Avoid overspending by setting limits

- Save more money with planning

- Plan for irregular costs like car repairs or holiday gifts

- Reach financial goals faster by sticking to a strategy

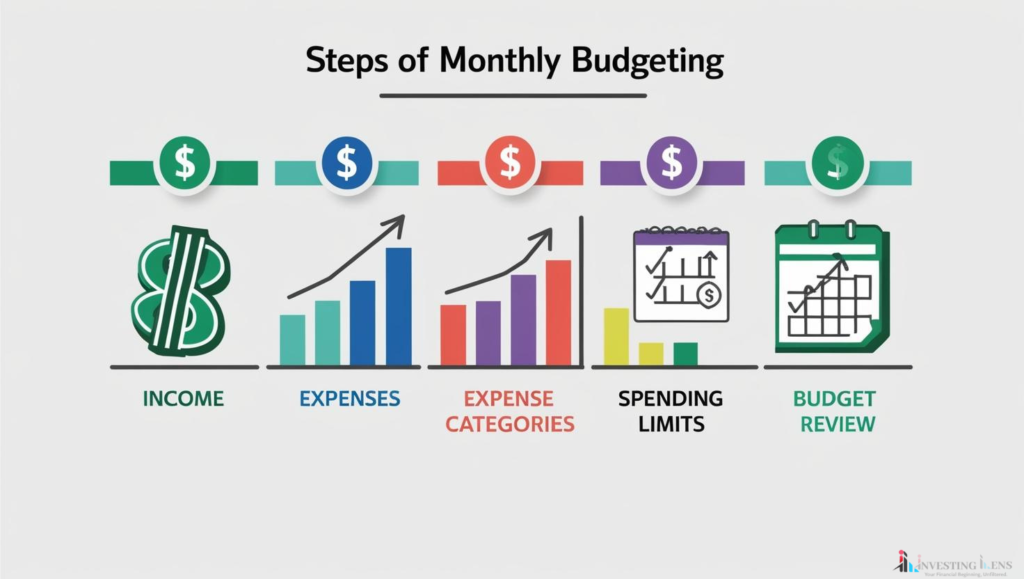

How to Create a Monthly Budget in 5 Simple Steps

1. List Your Income

Start by adding up all sources of income for the month—your salary, freelance work, side gigs, etc.

2. Track Your Expenses

Write down your fixed costs (like rent/mortgage, utilities, and subscriptions) and variable costs (like groceries, dining out, and entertainment).

3. Categorize Your Spending

Group your expenses into categories: housing, transportation, food, savings, etc. This helps you see patterns and spot where you can cut back.

4. Set Spending Limits

Set a reasonable limit for each category based on your income and financial goals. Make sure your expenses don’t exceed your income.

5. Adjust and Review Monthly

Life changes—so should your budget. Review your budget at the end of each month to track progress and make necessary adjustments.

Excel Monthly Budget Calculator – Simple & Effective

To make budgeting easier, use an Excel-based monthly budget calculator. These templates allow you to input your income and expenses, automatically calculate totals, and visualize your spending with charts and graphs.

Recommended Excel Monthly Budget Template

Microsoft Office Personal Budget Template

You can download it here:

👉 Microsoft Excel Budget Template – Personal Monthly Budget

Features:

- Pre-set categories for income and expenses

- Automatic totals and balance calculations

- Monthly comparison and savings tracking

- Easy customization for your needs

If you prefer something more advanced, you can create a custom template or use free budgeting templates available from websites like Vertex42, Smartsheet, or Google Sheets.

Final Thoughts

Budgeting isn’t about restricting yourself—it’s about permitting yourself to spend wisely. By planning your monthly budget, you’re making a conscious decision to prioritize your financial health and long-term goals.

Start simple. Stay consistent. And watch your savings grow.